Crisil

UX Portfolio

Financial Services

Risk Model Utility

Systematizing Financial Model Risk Management

The Regulatory Reality

Financial institutions live in a world of models. Credit risk models, market risk models, operational risk models - thousands of algorithms making billions of decisions that determine who gets loans, how much capital banks need to hold, and whether financial systems remain stable.

When these models fail, economies collapse. When they're poorly managed, regulators impose massive fines. When they're not properly documented, audits become nightmares.

Crisil's Model Infinity was designed to solve the chaos of model risk management through systematic process design and comprehensive oversight capabilities.

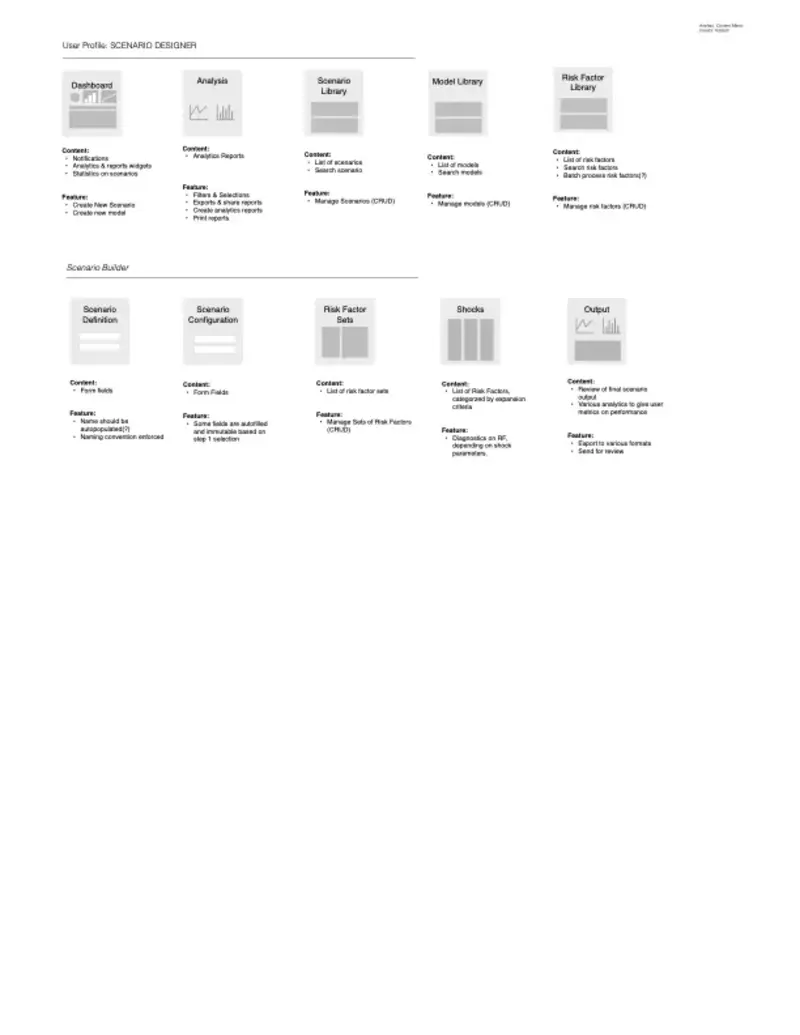

The Stakeholder Complexity Map

Model risk management involves more moving parts than most enterprise software. My research revealed a web of interdependent roles, each with different priorities and success metrics:

Model Developers create and maintain the algorithms

Model Validators stress-test and challenge model assumptions

Risk Managers oversee model performance and compliance

Auditors verify that everything follows regulatory requirements

Business Users rely on model outputs for decision-making

Each group needed different information, different workflows, and different levels of detail. The challenge was creating one platform that served all these needs without overwhelming anyone.

Process Mapping Before Interface Design

I spent weeks mapping existing model governance workflows - not just the official processes documented in compliance manuals, but how work actually got done.

Discovery findings:

- Model documentation was scattered across email, shared drives, and individual laptops

- Validation processes varied dramatically between teams and model types

- Version control was manual and error-prone

- Regulatory requirements were interpreted differently across departments

- Knowledge transfer during staff changes was inconsistent and incomplete

The current state was functional but fragile. Any process improvement had to acknowledge existing workflows while gradually introducing better practices.

Information Architecture for Regulatory Compliance

The platform's IA needed to accommodate three distinct requirements simultaneously:

- Operational efficiency for daily users

- Regulatory compliance for auditors and examiners

- Executive oversight for risk management and business leadership

I developed a layered architecture that could present the same underlying data through different lenses:

Operational View: Task-focused interfaces for model developers and validators Compliance View: Audit trail and documentation interfaces for regulatory reporting Strategic View: Portfolio-level dashboards for risk management and executive teams

Workflow Automation Design

The platform's core value proposition was automating manual processes while maintaining regulatory rigor. This required careful analysis of which steps could be automated versus which required human judgment.

Automation opportunities: - Document template population based on model metadata - Workflow routing based on model type and risk tier - Notification triggers for validation deadlines and regulatory milestones - Report generation for standard compliance requirements

Human oversight requirements:

- Model validation sign-offs

- Risk assessment judgments

- Exception approvals

- Strategic model governance decisions

Design for Multiple Mental Models

Different user types approached model information with completely different mental frameworks:

Developers thought in terms of model performance and technical specifications Validators focused on testing scenarios and potential failure modes Risk Managers considered portfolio-level exposure and concentration risk Auditors emphasized documentation completeness and process compliance

The interface design needed to accommodate these different perspectives without forcing users to adopt unfamiliar conceptual models.

Regulatory Constraint Design

Every design decision existed within regulatory boundaries defined by SR 11-7, TRIM, SS 1/23, and other global standards. This wasn't about adding compliance as a feature - it was about designing compliance into the foundation.

Design implications:

- All user actions needed comprehensive audit trails

- Data retention policies influenced information architecture decisions

- Role-based access controls determined interface complexity

- Documentation requirements shaped form design and validation logic

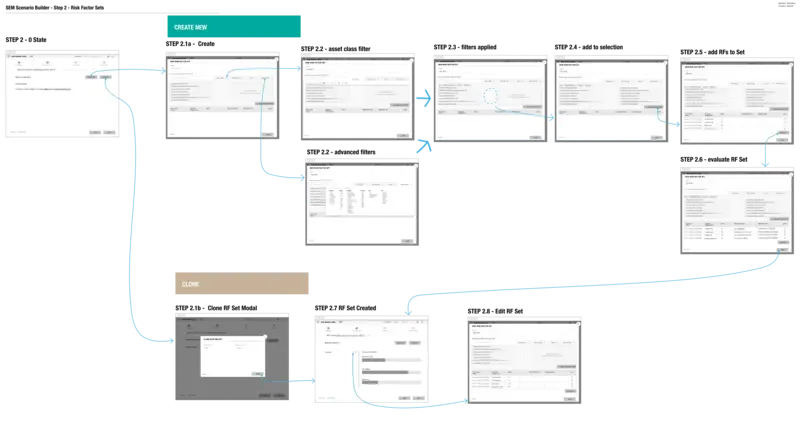

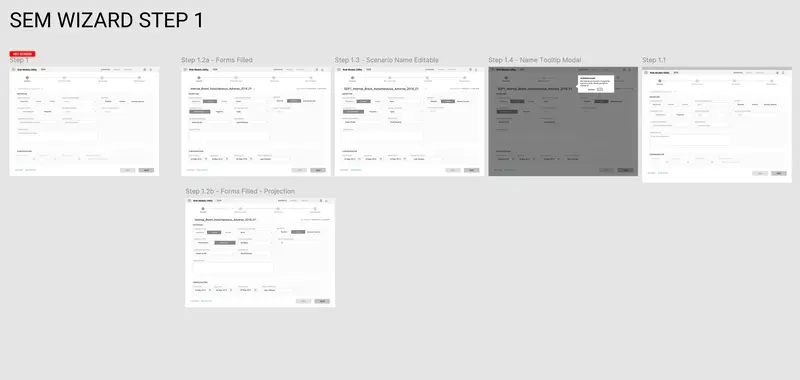

Prototype Strategy for Complex Workflows

Standard prototyping approaches didn't work for model governance workflows. These processes often span weeks or months, involve multiple stakeholders, and include exception handling that's difficult to demonstrate in typical demos.

I developed scenario-based prototypes that walked stakeholders through complete model lifecycle examples, including edge cases and error conditions. This helped validate both normal workflows and exception handling approaches.

The Implementation Challenge

Model Infinity needed to integrate with existing model development tools, risk systems, and regulatory reporting platforms. The design had to accommodate:

- Data imports from multiple model development environments

- Integration with enterprise risk management systems

- Export capabilities for regulatory reporting requirements

- API connections to facilitate workflow automation

This required interface design that could handle data inconsistencies and integration failures gracefully while maintaining user productivity.

Measuring Success in Regulated Environments

Success metrics for regulatory software are different from typical enterprise applications. User satisfaction matters, but compliance completeness matters more.

Primary success indicators:

- Reduction in model documentation time

- Improvement in audit preparation efficiency

- Decrease in regulatory finding severity

- Increase in model governance consistency across teams

Secondary indicators:

- User adoption rates across different stakeholder groups

- System uptime and performance during regulatory examinations

- Integration success with existing tools and processes

The Systematic Approach

Model Infinity succeeded because it systematized what had previously been ad hoc. The platform didn't just digitize existing processes - it created better processes and then made those processes easier to follow.

The user experience design supported this systematic approach by making the right actions obvious and the wrong actions difficult. Good governance became the path of least resistance.

Lessons in Regulatory Design

Designing for highly regulated industries requires different priorities than consumer software. Users will tolerate interface complexity if it helps them avoid regulatory problems. They value comprehensive functionality over simplified workflows.

The most important design principle was transparency - users needed to understand not just what the system was doing, but why it was doing it and how it supported their compliance obligations.

Model Infinity demonstrated that regulatory software doesn't have to be painful to use, but it does have to be designed with regulatory success as the primary objective.